Blended Finance: the Spanish experience

The purpose of this instrument, consisting of the strategic use of development finance and non-reimbursable resources to channel private capital to developing countries, is not to reduce costs, but to make projects viable that would otherwise not receive market financing.

The Spanish Development Finance Institution (Cofides), as an accredited entity, is able to structure projects for financing in the form of blended finance[1] within the framework of the Latin American Investment Facility (LAIF) and the Green Climate Fund (GCF).

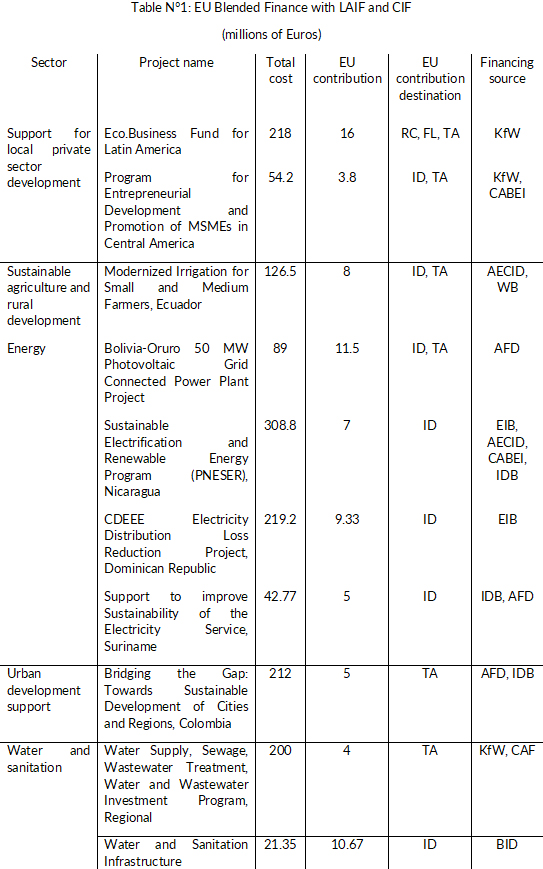

European Union (EU) blended finance consists of combining an EU donated component with a reimbursable component to finance projects that should be located within the geographic sphere of countries situated in regions that enjoy EU external cooperation and are in line with its priorities, contribute to the development of the recipient country, provide an additionality, and are economically, financially and technically viable and sustainable. The minimum total investment amount must also be between €8 and €10 million, and the project must have systems to control socio-environmental risks in place (Examples of EU blending are to be found in Table N°1).

Among the eligible sectors are transport, renewable energy, water and sanitation, ITC, agriculture and local private sector development. Blended finance is available to states, municipal governments, public enterprises and the private sector.

Among the eligible sectors are transport, renewable energy, water and sanitation, ITC, agriculture and local private sector development. Blended finance is available to states, municipal governments, public enterprises and the private sector.

Reimbursable financing instruments can take the following forms: as 1) debt: targeting the public sector, loans to states and the private sector for productive investment, finance institutions that intermediate with MSMEs and debt securities of special-purpose entities (SPEs) that target financial inclusion; 2) capital in the form of capital and quasi-capital for productive investment by the private sector, private venture capital institutions, and SPEs that provide support for the economic fabric or for MSMEs; and 3) guarantees.

Non-reimbursable resources for this financing come from Latin American Investment Facility (LAIF) funds that are available for financing in Argentina, Bolivia, Brazil, Colombia, Costa Rica, Cuba, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Paraguay, Peru and Venezuela. Funds in the case of the Caribbean Investment Facility (CIF) are to be used to favor Antigua and Barbuda, Bahamas, Barbados, Belize, Dominica, the Dominican Republic, Grenada, Guyana, Haiti, Jamaica, Saint Kitts & Nevis, Saint Lucia, Saint Vincent and the Grenadines, Suriname, and Trinidad y Tobago.

In granting loans for private sector projects for productive investment, aspects like the following are considered: the promoter’s commitment in the co-financing; the promoter’s capacity and experience; the project’s economic and financial viability; appropriate management of the environmental and social aspects; contribution to the development of the recipient countries; and corporate social responsibility. The financing is provided to a head company, project company or a vehicle corporation or nominee company. The financing ranges from €75 thousand to €35 million, with loan terms of from 3 to 10 years, grace periods and institutional support. Projects are financed in all sectors, except for real estate.

Insofar as financing with venture capital for private institutions is concerned, this must be provided for impact investing in companies, organizations or investment funds, with a view towards generating a social and environmental impact and producing a financial return.

A number of different criteria are also involved in venture capital investment, to wit: 1) alignment with EU geographic and sector priorities and OECD official development assistance (ODA) recipients. Sectors included in the International Finance Corporation (IFC) are excluded; 2) neither the Fund, nor any of its intermediate vehicles can be domiciled in tax havens, according to Spanish law; 3) investment in funds whose activity involves the transfer of ownership of basic social services to private hands, including water and sanitation, is excluded; 4) experience of the promoter team in similar investment vehicles. No more than two funds can be managed by the same promoter; 5) the promoter’s participation. Variable commitment in accordance with the size of the fund and the promoter’s resources, with a referential figure of 1% of the total fund resources; 6) duration and exit. Funds with preset periods or liquidity periods; 7) impact on development; 8) priority of operations that promote social, environmental and governance best practices; and 9) a ceiling on participation of 20% of the committed resources or of the Fund.

In the identification of loans to financial institutions for financial inclusion / microfinance, these must be intended to provide financial services to MSMEs or else directly through local retail finance institutions, or through those with wholesale activities; the financing is provided in dollars, euros or any other currency quoted by the European Central Bank; repayment is on a long-term basis and grace periods are always considered, there is no limit on the amount of the financing, it is adjusted to the creditworthiness and capacity of the borrowing institution; the loan interest rate is in line with the institution’s financing cost and market rates, but always complies with the percentage set by the OECD Development Assistance Committee (DAC); and the reimbursable financing must always be backed by sufficient guarantees.

The eligible finance institutions, by type, are: 1) private: formal institutions like downscaling/upgrading banks and non-bank finance institutions; semiformal (savings and loan cooperatives, credit or specialized NGOs, and community organizations belonging to the members); and informal (entities like, for example, pawnshops, community savings groups, borrowers, business persons, etc.); and 2) public: formal (official banks) and semi-formal (national or international programs and projects, and government organizations).

Targeted finance institutions must direct the resources toward the low-income population, microenterprises with no documentary information about their activity and lacking real guarantees; small and medium enterprises (SMEs) that are more formal and have more financial education require a broader range of financial products and generally real guarantees; and have a staff that is more attuned to their customers’ environment or particular situation.

Process and structuring

EU contributions are to be used for: 1) donations: to reduce the total project cost, thus facilitating project finance; 2) risk capital: to attract additional financing by, for example, covering the first-loss segment; 3) technical assistance: to improve the project’s quality, efficiency and sustainability (feasibility studies, education and training, etc.); and 4) guarantees: to reduce the political, credit, exchange or other risk, depending upon the project.

Projects, in order to accede to blended finance, follow a process consisting of the project analysis (financial and socioenvironmental risks, impact on development, EU additionality and alignment with EU priorities); structuring of the operation (co-financers); presentation of the project to the EU at the Technical Assessment Meeting, where the project is discussed technically with other accredited institutions; submission to the EU Board made up of the member states, which must approve the operation; presentation of the project to possible co-financers; organization of the bidding competition, dissemination of information and award of the bid; formalization, hiring and disbursements; and follow-up.

Green Climate Fund (GCF)

The GCF is a United Nations initiative to finance climate change mitigation and adaptation projects in developing and emerging countries. It finances activities aimed at reducing greenhouse gas emissions or increasing CO₂ capture (mitigation), and at promoting the resilience of both people and the natural environment to the effects of climate change (adaptation). GCF commitments total US$10,210 million, of which US$7,000 have been disbursed. GCF reimbursable funds, unlike those provided by the EU, can also be concessional.

Cofides is a public-private institution with broad experience in financing international private projects (over 950 projects totaling more than €3,000 million in 90 countries); in the past 7 years, it has financed some 35 climate mitigation and adaptation projects for a figure in the neighborhood of €180 million (its fund-raising approached €5,500 million); accredited to the GCF, it is able to structure public or private projects of up to US$250 million, with any socio-environmental risk level whatsoever.

It accordingly allows for the submission of projects to the GCF and regularly holds bidding competitions for projects open to GCF financing and invites public and private institutions to submit projects. In order to determine the projects’ eligibility, Cofides bears in mind a series of criteria for exclusion and for prioritization.

- Criteria for exclusion consider: 1) Economic criteria: Project cost: between US$10-US$250 million; currency: US$ or euros; maximum Cofides financing: 20% of the total or US$30 million, maximum GCF financing: 25% of the total project cost; the donation is a maximum of 5% of the GCF contribution, leverage: a minimum of 1:3 and financial model; 2) Coverage criteria: eligible developing and emerging countries located in one of the GCF eight areas of impact and which are in line with GCF investment criteria; 3) Other criteria: local interest: aligned with national priorities, 10-year maximum financing period with 15 years in special cases.

- Criteria for prioritization: 1) Economic: minimum leverage of 1:3, minimum concessionality, the financing structure is a PPP and the financing is in US$; projects are located in Latin America, the Caribbean and Sub-Saharan Africa; and investment efficiency in mitigation and adaptation to climate change; 2) Technical: Experience and presentation of final studies

Example of Cofides blended finance

Huruma Fund

First project led by Cofides through the AgriFi subject matter facility. Promoter: GAWA Capital Partners, S.L. This impact investing fund seeks to improve access to financing in rural areas by supplying financing to small or excluded farmers. The total sum for investment is €100 million and the area for investment is Latin America and the Caribbean, Sub-Saharan Africa and Asia.

The fund’s shareholding structure is: private sector €69 million, the Spanish Agency for International Development Cooperation (AECID) €20 million, Cofides €1 million and the EU €10 million. The EU’s total contribution is €18.8 million, divided into first-losses €10 million, technical assistance €8 million, and audit and evaluation €0.8 million. The amount is up to €9 million for the technical assistance facility, with a view towards providing consulting and training services in subjects relating to agriculture; and helping to upgrade entities in which the fund invests in order to enhance their impact on the excluded rural population.

[1] Blended or combined finance is defined as the strategic use of development finance and non-reimbursable resources to channel private capital to developing countries for impacting investment, in order to attain the Sustainable Development Goals (SDGs) adopted by the United Nations.